Launched in 2009, Bitcoin (BTC) is the world first and largest cryptocurrency by market cap. BTC is well known for its extreme price volatility, and the recent price of BTC has hit an all-time high of over $41,000 in January, 2021.

The first Bitcoin contract was created by the Chicago Board Options Exchange (CBOE) on December 10, 2017. One week following the launch of BTC futures by CBOE, the world’s largest futures exchange, CME announced the launch of its Bitcoin futures contract on its platform.

The introduction of Bitcoin futures has made a tremendous impact in the BTC market, as a lot of institutional investors are looking to get benefit from Bitcoin’s volatility without investing in an unregulated spot market.

What Are Bitcoin Futures?

Bitcoin futures is a type of derivative product that allows investors to get exposure to the Bitcoin’s volatility without holding any Bitcoin. Futures is referred to as a legal agreement to buy or sell a particular commodity asset at the specified time and price in the future.

Investors trade futures contracts by speculating whether the future price of Bitcoin is going up or down. Investor takes a long position if he thinks the price will go up, and takes a short position if he expects the price will go down in the future.

Unlike buying or selling an actual Bitcoin, Bitcoin futures settle in cash, and do not involve any BTC, therefore investors do not require to hold a Bitcoin wallet to trade the futures contract.

In January 2019, the world longest-running cryptocurrency exchange, BTCC launched the world’s first physically-delivered perpetual contract. Physical-delivered futures contracts mean investors can have their futures settled in Bitcoin. Within 24 hours after the launch, the trading volume exceeded RMB 1 billion.

A few months later, backed by Intercontinental Exchange, Bakkt launched its physically-delivered daily and monthly Bitcoin futures contracts on September 23, 2019.

The Benefits to Trading Bitcoin Futures

Unlike the spot market, you can only make profit if the price goes up. With a futures contract, you can take benefit of Bitcoin’s volatility by either going long or short. Shorting means investors employ an investment strategy to profit if the price of the asset drops. By shorting Bitcoin, investors also can mitigate Bitcoin’s volatility by hedging against a long exposure of holding BTC positions.

Another benefit of futures contracts is leverage, which means investors can maximize their profit/loss on Bitcoin’s volatility with relatively small capital, known as margin. For example, to open one lot of BTC/USDT weekly contracts with leverage of 100x at BTCC, an investor would only need to have 350 USDT as margin.

A Guide on How to Buy & Sell Bitcoin Futures With BTCC

BTCC offers three types of futures contracts: daily contract, weekly contract, and perpetual contract. Each futures contract has a different expiry date, and leverage. For example, BTC/USDT daily contract expires daily and offers 150x leverage. BTC/USDT weekly contract expires weekly and offers 10x, 20x, 50x and 100x leverage. And BTC/USDT perpetual contract has no expiry date and offers 10x, 20x, 50x, and 100x leverage.

Investor can choose the type of futures contract and leverage that suit their need and risk appetite.

Step 1

To buy or sell Bitcoin futures at BTCC, you need to register an account, and complete KYC first. You can sign up with your email or mobile phone number. Or sign up in BTCC trading app. You can download the app from Google Play store or App Store. You can also try the Demo account with virtual currency on BTCC app.

Step 2

After you complete KYC, you can deposit USDT into the account. BTCC support USDT-ERC20 and USDT-OMNI.

Or you can buy USDT on the exchange’s website. BTCC support credit card payment method included BCcard, Visa, and MasterCard.

Step 3

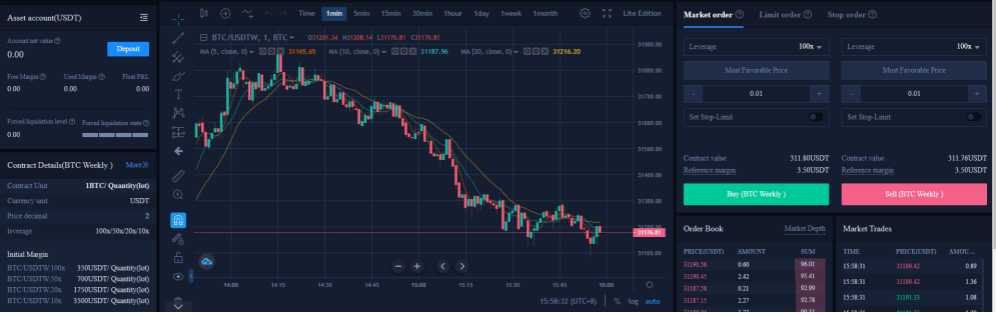

After you make your first deposit. You can head over to the trading screen, and on the right-handed side of the web trading platform. You can select buy or sell, leverage level and the number of lots for your trade.

There are three types of orders to choose from, namely market order, limit order and stop order. Market order is a type of order that execute the buy or sell order immediately at the current market prices.

Both limit order and stop order mean the order will be executed if the price meet certain level, the difference is limit order is visible to the market and will be executed when sellers choose to meet the price, whereas stop order is not visible to the market and only be executed if the stop price has been met or exceeded.

BTCC is the world’s longest-running cryptocurrency exchange, the exchange was launched in 2011, and has never experienced any security incident. For new users, you can now claim up to 2000 USDT trading bonus with your first deposit at BTCC.

BTCC official website: https://www.btcc.com

In addition to the English market, BTCC is also available in Korean (비트코인 선물거래), Japanese (ビットコイン先物契約), and Vietnamese (Hợp đồng tương lai Bitcoin).

Support Zerocrypted

- Trade on Bitmex

- Trade on Binance Jersey

Subscribe to our Newsletter to be a part of our future $1,000 per month contests.