Coinbase and Bitfinex are among the most popular cryptocurrency exchanges globally. The two exchanges were both founded in 2012 with a focus on different clients. Coinbase is located in the United States, while Bitfinex has its offices in Hong Kong. It is important to note that Coinbase is available in selected countries while Bitfinex stopped serving US customers in 2018.

Coinbase brokers exchanges of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, and Litecoin with fiat currencies in approximately 32 countries, and Bitcoin transactions and storage in 190 countries worldwide. On the other hand, Bitfinex is one of the market’s largest and most liquid exchange services providers. The platform customers are attracted by its offerings of leverage and more advanced trading tools. Despite these two platforms offering cryptocurrency exchange services, they do have some variations in terms of the services they offer. In this article, we look at Coinbase Vs. Bitifinex.

Getting Started

Both platforms require users to sign up before they start trading. On Coinbase, you will provide your name, email, password, and location. Complete the captcha, then certify that you are over 18 and agree to the Coinbase user agreement and privacy policy. To verify your identity, submit your government issued ID. Coinbase also requires you to provide your phone number for verification.

The Bitfinex sign up process is easy. Just visit the website and provide your name, email, and desired password and verify your account. The initial sign up does not require ID verification. The process of confirmation is simple. However, it involves any form of legal documentation. You will provide, your name, ID to confirm your identity in a process that can take up to 48-hours.

Supported Cryptocurrencies

Coinbase is limited based on the number of cryptocurrencies its supports. The platform supports BTC, ETH, BCH, LTC, ETC, ZRX, and BAT. Many traders usually find this as a limiting factor. It is not clear if Coinbase will be adding more assets in the future. Coinbase allows customers to purchase cryptocurrencies using a credit card or bank wire. However, Coinbase is limited in terms of payment options available.

Bitfinex emerges as the winner. The platform supports more than 30 cryptocurrencies including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, BAT among others. On Bitfinex, users can deposit fiat to their accounts. The platform supports USD, GBP, JPY, and EUR.

Security and Privacy

Coinbase good reputation in the cryptocurrency market is due to its security features. Since being established, the exchange has not suffered any security breach. Coinbase uses the 2-factor authentication feature and PIN support to secure accounts. The platform also has three wallets types; Coinbase Bitcoin Wallet, Coinbase Vault, Multisig Vault. All the wallets have advanced security features. Because Coinbase has buy/sell features, it must follow all KYC laws. There have been reports that Coinbase tracks how its users spend Bitcoin.

On the other hand, Bitfinex does not have a good reputation, security wise. The platform suffered a hack in August 2016, where 120,000 Bitcoins were stolen. However, the platform has managed to recover. To secure user accounts, Bitfinex uses two-factor authentication and the universal second factor.

Trading Fees

Generally, Coinbase is an expensive cryptocurrency exchange. However, the fees vary. The variable fees depend on your location, payment method, and whether you’re placing a “standard” order or an “instant buy/sell.” You will be charged the higher of either the flat fee or the variable fee for buying and selling. Coinbase has a 1% fixed trading fees while deposit fees vary. The same variation also applies to Coinbase withdrawal fees.

On the hand, Bitfinex has some of the attractive fees in the market. The platform trading fees stands at 0-0.2%. For withdrawals, Bitfinex does not charge anything unless it is wire transfers.

Margin Trading

Coinbase does not support cryptocurrency margin trading. However, reports indicate that the platform is working in a plan to launch margin trading. However, Coinbase sister exchange Coinbase Pro supports Margin trading. Margin trading is viewed by many as the only option leading exchanges can survive the crypto market with big banks entering the space. Bitfinex has been offering margin trading for some time now. Bitfinex offers various forms of margin trading. There is a margin trading which allows you to borrow more than you currently own using your crypto as collateral. Note that margin trading attracts a higher profit potential than traditional trading. However, it comes with several risks.

Trading Chart Indicators

Advanced cryptocurrency traders mostly use trading charts. The charts help traders identify the direction of terms, find trends reversal, and show potential support. Coinbase does not offer trading charts. Trading charts usually make trading platforms cluttered something that confuses new traders. This is the same reason why Coinbase is the best exchange for newcomers. Trading charts are available on Coinbase Pro. Bitfinex offers trading charts at different levels. The charts provide traders with different insights to guide them in their trade.

Mobile App support

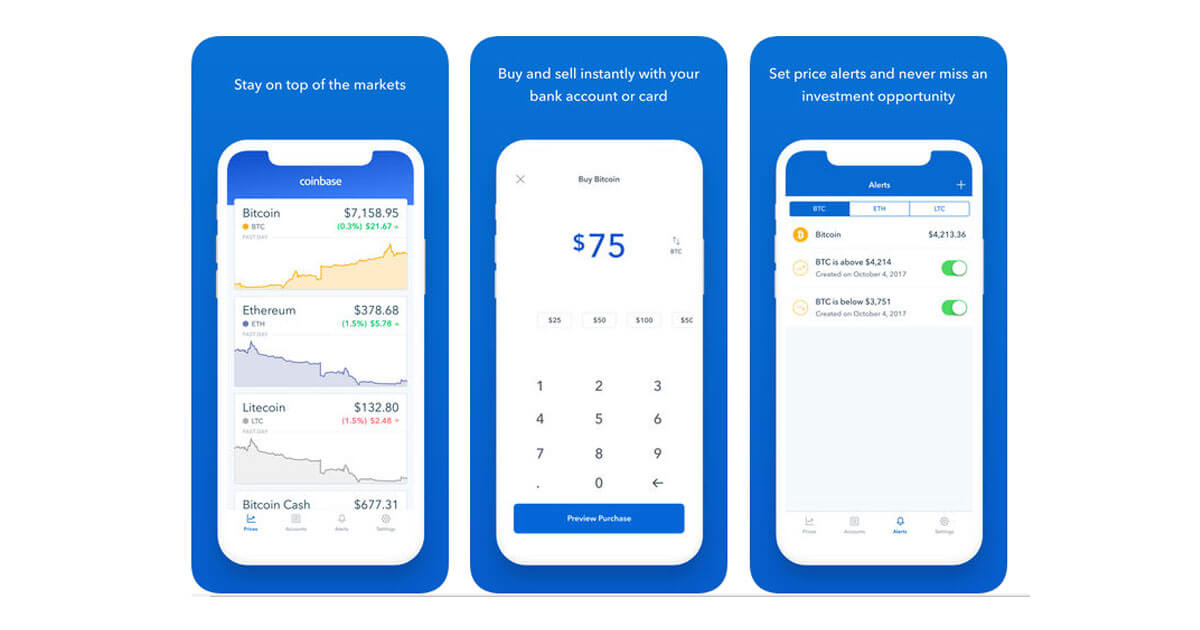

Both Cpoinbase and Bitfinex have a mobile application that makes trading easy. Both applications are compatible with Android and iOS devices. However, the Coinbase app stands out thanks to the intuitive user interface. On the other hand, some users find the Bitfinex application a bit cluttered with too many details. This aspect might confuse inexperienced users.

Customer Support

Coinbase customer support service is available 24/7. The platform has an email and phone number support system. However, due to the Coinbase large customer base, getting help might take longer. Coinbase also has a regularly updated FAQ section. This section contains all the information about Coinbase. You will find guides on getting started and some of the security features put in place by Coinbase.

Similarly, Bitfinex also has 24/7 customer support service. Clients need assistance can also reach the exchange via phone or email. Additionally, under the FAQ section, you will find all you need to know about Bitfinex. You can also interact with the team through social sites like Twitter and Facebook.

Pros and Cons

Coinbase Pros

High liquidity Integrated debit and credit cards Newbie friendly

Coinbase Cons

- Major violations of users privacy.

- Puts investors before customers.

- Segwit still not supported.

Bitfinex Pros

- High USD liquidity

- Low Fees

- Full package of order types, margin trading, and lending market

- The hack has been solved professionally.

Bitfinex Cons

- Not a transparent company

- Reputation loss due to hack

- The unclear situation with USDT (Tether)

Conclusion

There is no doubt that both Coinbase and Bitfinex are among leading global cryptocurrency exchanges. Coinbase has maintained its status in the market while Bitfinex has managed to bounce from the hack that resulted to loss of 120, 000 Bitcoins. The platforms offer attractive products to their customers. However, there are some shortcomings that each exchange needs to address. Coinbase fees have been cited as costly something that might turn away potential customers. Additionally, the transaction needs to expand its cryptocurrency base and also the number of countries. On the hand, Bitifinex needs to assure customers that the security breach will not happen again. Some users are still skeptical about using the exchange.

Support Zerocrypted

- Trade on Bitmex

- Trade on Binance Jersey

Subscribe to our Newsletter to be a part of our future $1,000 per month contests.