The financial community has matured in its securities trade. This has allowed programmers to laisse with professional investors to develop security exchange terminals with all the useful advanced features needed to succeed in this trade. The cryptocurrency trade borrowed much of its basics from conventional securities trading. However, most of the cryptocurrency exchanges available today only offer the most basic features. Advanced traders rely on trading terminals which offer advanced features that they need.

Unfortunately, not all trading terminals are built the same. Some fail to provide many of the important features found in conventional trading, such as limit orders and trailing stops. Step-forward, Superorder – an advanced next-generation crypto trading platform with a focus on automation features! Read on to find out more about Superorder.

Why Do You Need a Terminal?

Trading terminals offer more advanced features than those offered by cryptocurrency exchanges. Most exchanges only go as far as providing the useful information needed to exchange currencies for another. Other than that, they lack most of the tools that professional traders require to make profits in the highly volatile cryptocurrency market.

The decentralized nature of cryptocurrencies is the very reason why trading terminals are important for successful trading. Securities trading is centralized, with bodies such as commercial banks regulating the stability of the financial markets. Cryptocurrency trading, in comparison, operates independently.

Most of the crypto exchanges trade with each other, but due to the decentralized nature of the trade, traders get different levels of liquidity based on the exchange they use. As a result, traders find it difficult to trade in quick-moving markets and to trade large orders. Trading terminals like Superorder bridge this void by providing all useful tools in one platform and integrating these tools with exchanges recognized by traders.

What Makes Superorder so Super?

Trading terminals out-do exchanges by providing more advanced features for crypto trading. Superorder provides these features in a more superior and efficient manner than its competitors.

1. More Orders

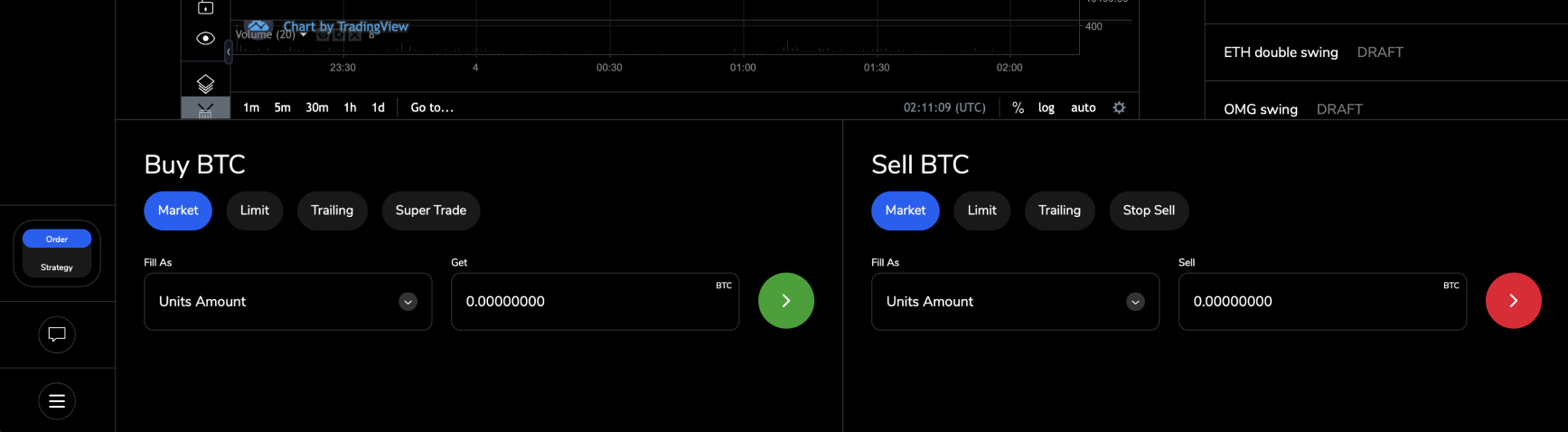

Traders who trade as a hobby can do with the basic orders offered by most cryptocurrency exchanges. These include:

- Limit buy/sell orders – these are the maximum and minimum prices which cryptocurrency traders are willing to buy and sell their coins for.

- Market buy/sell orders – these are the actions according to which traders buy and sell at the given market price.

Superorder provides its users with superior orders to make their trading more efficient. They include:

- Limit stop loss orders – this is the limit beyond which a crypto trader does not want to make losses. They protect you from selling a crypto coin below the price you bought it for.

- Limit take profit orders – these specify the exact price at which you should close an open position in order to realize the desired profits.

- Trailing stop orders – they act as dynamic stop loss orders that automatically move when the price moves.

Let’s talk about trailings in more detail. Superorder allows traders to set their sell and buy trailing. Sell trailing stop orders allow traders to set a fixed stop price of the coins below the market price. They then attach a trailing price to this amount. When the coin market price rises, the stop price also rises with the trailing amount. When the market price falls, the stop price remains unchanged. The cryptocurrency coins are then sold at the current market price, an execution known as a market order.

Sell trailing stop orders give traders the advantage of setting the maximum loss they are willing to take while not limiting the maximum profits they stand to gain. Buy trailing stop orders, on the other hand, give traders the advantage of setting the maximum profits they wish to gain without limiting the maximum losses. They are best used by bears trading in a falling market.

2. More Markets

Cryptocurrency exchange platforms only allow traders to trade one crypto coin for another, in the same market. Superorder trading terminal gives its users access to multiple exchange platforms. It currently supports Binance, Bittrex, BitMEX, and CEX.IO exchange platforms, with support for other exchange platforms such as Coinbase coming soon.

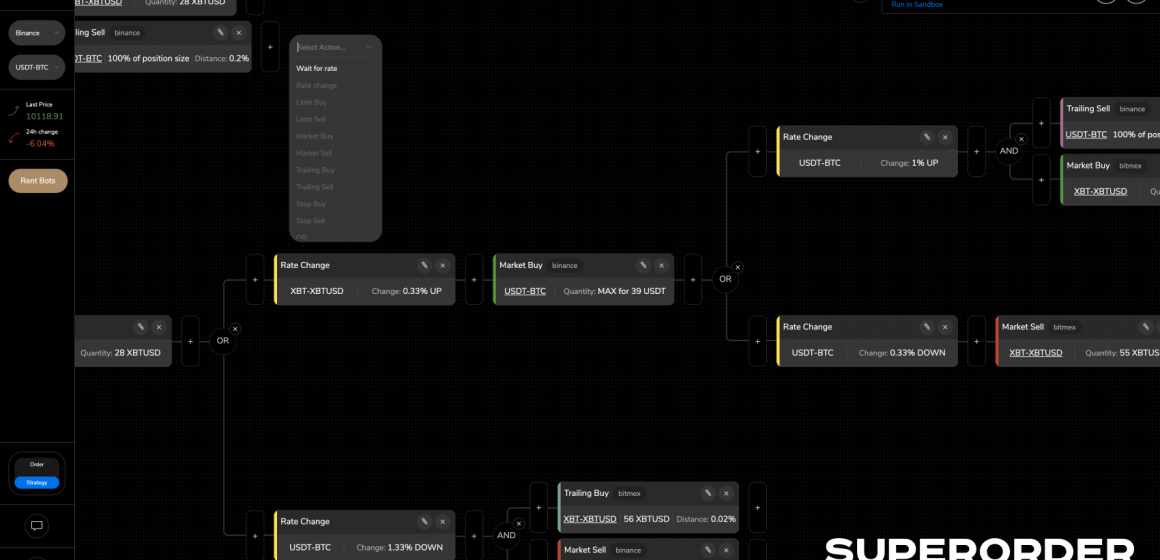

3. Automation

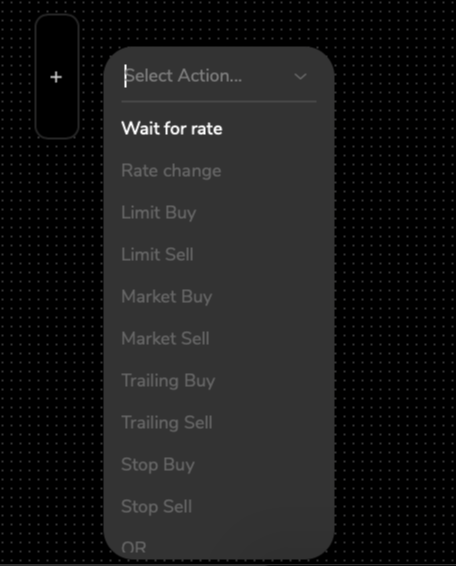

Superorder’s main stronghold is its automation power. Unlike other trading terminals, superorder provides traders with a tool that allows them to automate their trading without the need to code. It is a useful feature for any trader with zero experience in programming. All you need to do is drag your parameters and drop them in the strategy builder found inside Superorder. The automation feature lets traders set up the following parameters quickly:

- Market buy/sell

- Limit buy/sell

- Stop loss

- Trailing stop

- Wait for rate

- Indicators

- Forks

Once set, the parameters collectively form a trading plan which guides Superorder in automatically trading on your behalf. Traders need not spend hours monitoring their terminal as Superorder takes care of everything while protecting their earnings.

4. Extended Chart Frames

Progressive trading relies on the accuracy of analytic charts for forecasting. Unfortunately, crypto exchanges do not provide comprehensive charts for forecasting. Superorder bridges this gap by providing traders with extended chart frames with useful historical trading data. Traders can use these charts to test their trading strategies and forecast their trades.

5. Portfolio Management

Superorder offers superior portfolio management that advanced traders will come to appreciate. Traders need not visit each of their exchanges to view their portfolio. Instead, Superorder pulls data from different exchanges and manages your portfolio for you. What traders get is a clean presentation of their entire crypto portfolio. It is an extremely convenient feature that enables traders to spot any unnoticed losing trades or any positions that may have grown too large.

Parting Shot

In the relatively young world of cryptocurrency trading, it pays to trade with all the necessary tools that help you secure higher profits while protecting your losses. Superorder not only offers this but goes above and beyond by performing this automatically. Traders accustomed to other crypto exchanges such as Coinbase will have to wait for Superorder to support it, but it is otherwise a perfect automated terminal for every other cryptocurrency trader.

Support Zerocrypted

- Trade on Bitmex

- Trade on Binance Jersey

Subscribe to our Newsletter to be a part of our future $1,000 per month contests.