Wirex is UK-based startup that that offers cryptocurrency wallets linked to debit cards, digital currency and fiat currency. The firm also offers payment solutions. Wirex services are accessible through its website and mobile applications. In this article, we’d present an unbiased Wirex review.

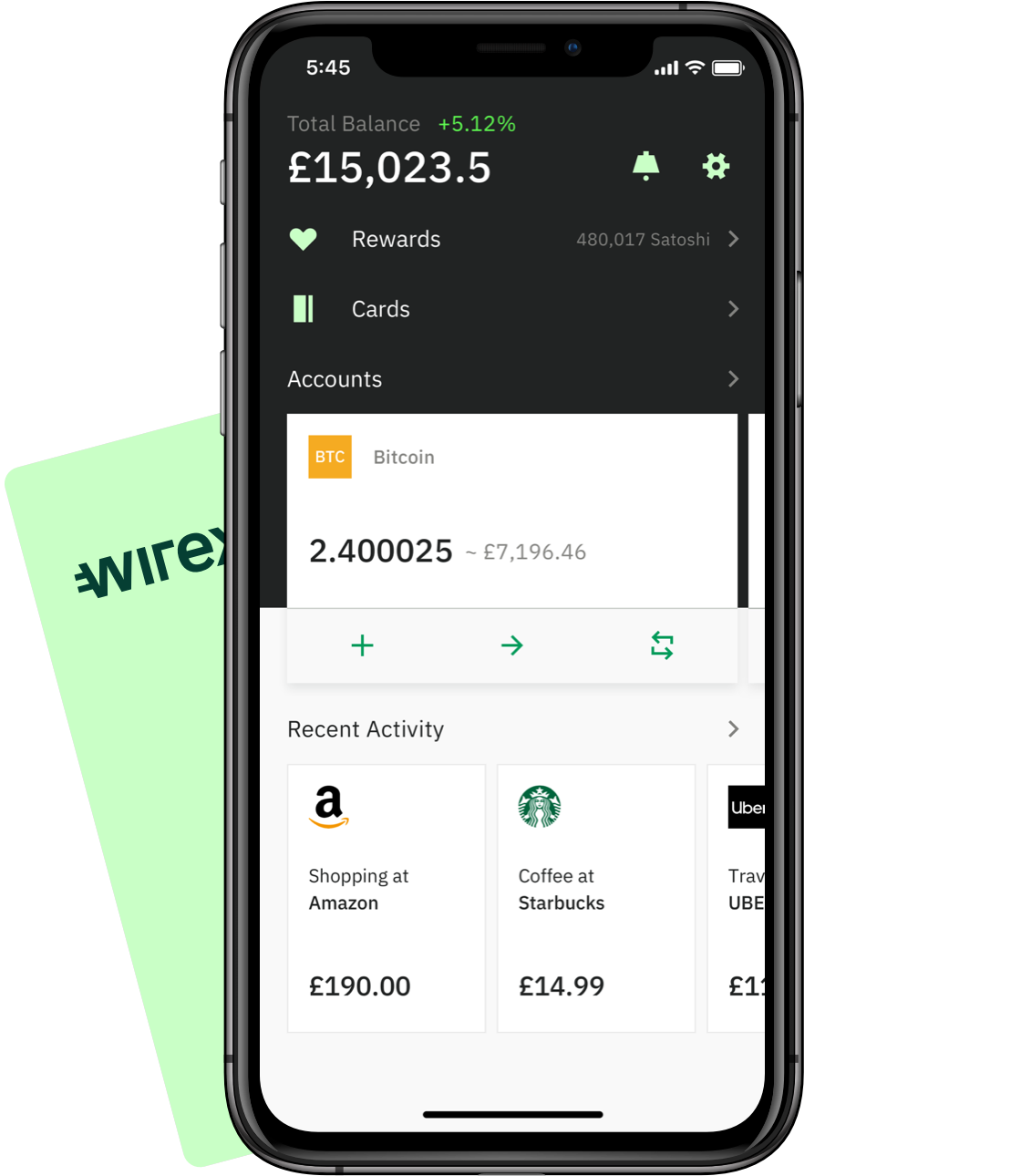

Wirex cards are probably the most easy to use solution to store and spend cryptocurrency in day-to-day life. The Wirex app provides a Visa card that lets you convert and spend digital currencies just like traditional money. You can use the card in any Visa accepted outlets.

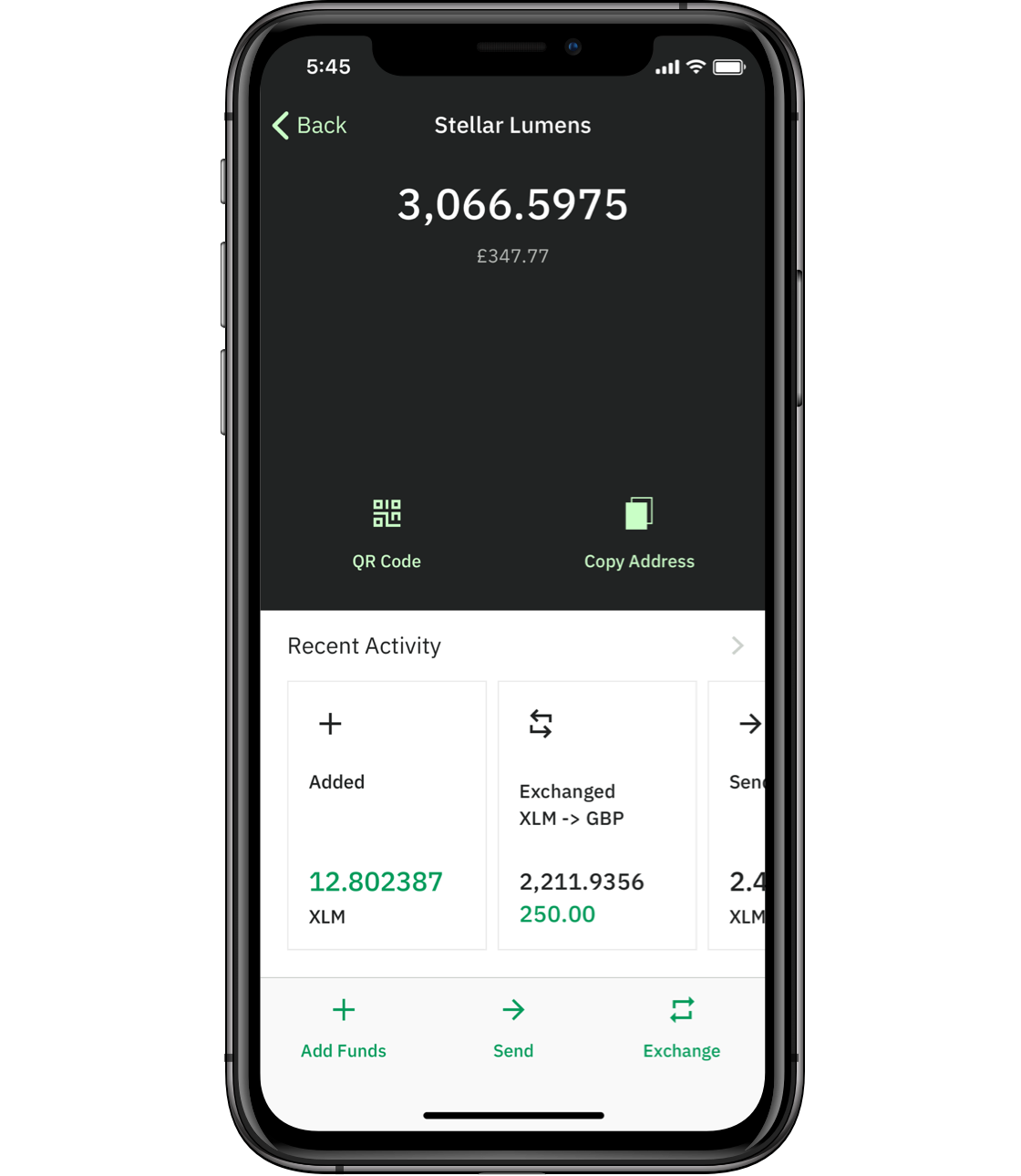

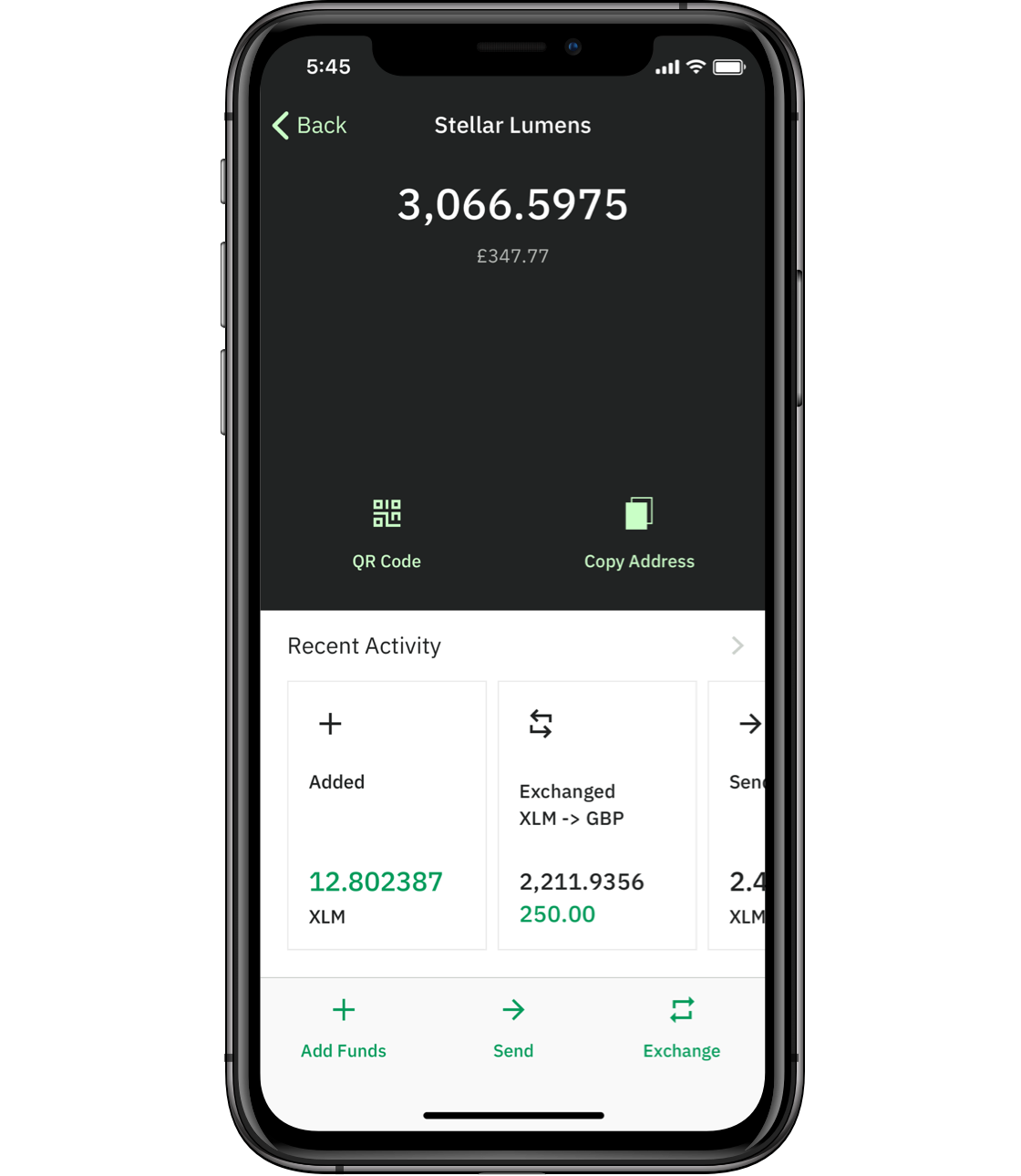

Furthermore, the Wirex mobile application is used to convert, send and manage accounts and funds.The Wirex platform is set on a state-of-the-art blockchain technology to enhance effective digital money transactions. Wirex supports the British Pound, the Euro and the US Dollar under the fiat category.

On the other hand, the service supports Bitcoin, Litecoin, Ethereum, WAVES and XRP under cryptocurrencies. Wirex services are available in about 130 countries with a plan to expand in the United States soon.

Getting Started with Wirex

Opening an account with Wirex is free. All you need is a valid email address and mobile phone for verification. Customers can register through the Wirex website, mobile or desktop application. Before enjoying certain features, customers are required to provide Proof of Residence (POR) and Proof of Identity (POI).For POR, customers can use a utility bill or a bank statement.

For Proof of Identity, you can use a state-issued passport, driver’s licence, identity card or a work permit. All POI documents should indicate the customer’s full names. The authentication of documents lasts between seven and ten days.

Once verified, users can then apply for a Wirex Visa card. The card is connected to any of the supported cryptocurrency wallets. Users who apply for a GBP or EUR card, are given an associated currency account. Users with verified accounts can use Wirex to convert cryptocurrencies into fiat and send also send money anywhere without the need of a bank. Lastly, the Wirex wallet comes with Shapeshift integration which supports the deposit of major cryptos to the Wirex account.

The card delivery is free and from my experience – it won’t take too long. Please note that Wirex card is a prepaid card same as the Coinbase card or any other bitcoin debit card. The account and wirex card are linked – meaning you can add money on your card from you wirex app.

Wirex Security Features

The success of online wallets majorly depends on security. Wirex is PCI DSS certified, a unique security feature that is in line with current industry standards. Wirex has other exciting security features that are attractive to customers, such as:

– A dashboard that allows customers to view transaction of their accounts the card.This feature makes it easy to identify any suspicious activity on the online wallet and card. Customers can block a card anytime if it’s lost or stolen from the website and the application.

– The card also is activated with ease once recovered. Notably, none of the Wirex employees has access to a customer’s card detail. This information is secured by card proxies stored with Wirex bank.

– All Wirex wallets feature the Multi-Sig technology. The system ensures that all parties involved approve the transfer of funds. The technology generates unique codes that can be used by each user.

– Wirex website eliminates intervention of intermediaries through SSL encryption. Wirex platform uses the 256-bit SSL

– Personal wallets created by Wirex are not stored on the platform’s servers. A customer gets an own wallet with three private keys stored on various devices. This model is attractive to customers because it minimizes the chances of being hacked.

– Most of the online transactions use 3d secure – which is perfect for a Visa payment card.

– SCA is also something implemented by Wirex which really makes a difference. Strong Customer Authentication can be bothering if we’re talking about low amounts, but in this case – the security measures taken by Wirex Limited are among the best to protect your digital assets.

– Of course, 2FA can’t miss this list – especially for the Wirex mobile app.

Wirex Fees And Limits

Any Wirex account holder is required to pay a monthly fee for maintenance in case he’s from EEA. The Card maintenance fee is 1 GBP/ 1.20 EUR or respective 1.5 USD.

The amount is payable regardless of the account activity and is deducted from your funds. In the event your card or account has no funds, it automatically goes to negative figures, and a customer is required to top up. Failure to pay the fees after two months may lead to account and card deactivation.

There’s a 1% fee for digital currency top up, while if you use a traditional currency – its free. Basically, each time you’re adding funds on the wallet, talking about cryptocurrencies, you’ll get with 1% less.

ATM withdrawals have some low fees as well, having a 1.75 GBP/ 2.25 EUR or 2.50 USD within the EEA. More details about fees and limits of Wirex mobile app can be found here. As a Wirex customer, you’re also entitled to get a cashback percentage of up to 1.5% in BTC – depending on your WXT balance. Holding over 500,000 WXT ( $4,400) could get you the maximum cashback. You can check the WXT price prediction to know more about WXT.

Given the fact Wirex rewards are up to 1.5%, the low fees are ok if you’re spending more than $1500 a month.

How Top Up A Wirex Account

You can add funds to a Wirex account using credit/debit cards, UK bank transfers, SWIFT, SEPA, FPS and exchanging the cryptocurrencies into fiat. Wirex only supports a maximum of $5000 per day when making a deposit using debit or credit cards.

If you are holding cryptos in a specific wallet, you can easily make the exchange within the Wirex account. It is important to note that any Wirex card linked to a currency account have the same balance. The card can be used for online payments while the account is essential in transacting cryptocurrencies, top-ups using traditional banking methods.

Adding funds to the wallet app is easy, as you have plenty of ways to do so: Bank transfers ( SEPA, SWIFT, FPS), converting Crypto to FIAT or trough a credit card. The topup charges are pretty low and the fact that Wirex uses interbank rates is a major benefit.

Buying Cryptocurrencies with Wirex

Wirex makes purchasing multiple cryptocurrencies easy. Multi-cryptos are bought instantly after loading your account or card using services like PayPal. The transaction is free of charge.

The process of buying cryptocurrencies entails verification of identity. A customer is required to upload an ID and physical address to aid the Know-Your-Customer process. The purchased cryptos are stored in a wallet provided by Wirex. A customer can send, save or convert the cryptos to fiat currency.

Customer Bonuses

Just like major financial platforms, Wirex has bonuses for customers. For every completed transaction, a customer gets 0.5% of the purchasing value in bitcoin. The revenue from this bonus can accumulate into a considerate amount if you keep collecting cash backs. The crediting is instant.

Wirex User Interface

The Wirex platform is simple and easy to use. The design is user-friendly. Wirex mobile app has a unique functionality. The app integrates access to the exchange, card services, wallet all in one interface. Additionally, the Wirex debit card operates just like any other card.

Wirex combines an online wallet, exchange, and a crypto debit card in one place. This feature makes spending and transfer of multiple cryptocurrencies possible. It is suitable for users on the move. Additionally, the debit card’s ability to spend significant cryptocurrencies all at once puts Wirex in a unique position amongst other cryptocurrency debit card rivals.

Wirex Supported Currencies

Wirex have a large list of supported fiat currency. Besides the clasic GBP EUR and USD – Wirex also accepts SGD, AUD, JPY, HKD, CZK, MXN, CAD and CHF. Unfortunately, any foreign currency besides the list above is not accepted by Wirex.

And in case you were wondering if Wirex is reglemented by Financial Conduct Authority – Yes, it is – as stated on their website:

Wirex Limited is authorised by the Financial Conduct Authority (FRN: 902025) under the Electronic Money Regulations 2017 for the issuing of electronic fiat money and payment instruments

Also, the crypto assets accepted are the following ones: BTC LTC ETH XRP WXT XLM DAI NANO WAVES. The cryptoback rewards that Wirex are offering are bitcoin rewards. Meaning that for each transaction a user makes – he receives compensation equal to 0.5%, 1% or 1.5% – based on his WXT amount.

If you’re interested in exchanging currencies, Wirex made a live rates page where you could see the cost of exchanging digital assets and all other supported currency.

Frequently Questions about Wirex

Does Wirex have a cryptocurrency exchange?

No, Wirex limited doesn’t own any cryptocurrency exchange but they’re connected with more than 10 to offer the best rates:

Wirex strives to make the buying and exchanging of digital and traditional currencies simpler and more secure. We achieve this by integrating with 10 different exchanges and 3 OTC institutions to obtain the best currency pair pricing for each customer.

What are the Wirex account limits?

The Wirex account limits can be found here.

Is Wirex Safe?

Of course, as mentioned – it was approved by the Financial conduct authority and their security is among the best ones – even if we’re talking about card purchases or your current account. In our Wirex review, we’ve checked all the security measures implemented to keep Wirex safe from hackers or other 3rd parties.

Does Wirex have a virtual card?

No, Wirex doesn’t have a virtual card yet.

Are there any transaction charges that I need to know when using Wirex?

Wirex fees are pretty low and you can read more about them here. The conversion fees are on an interbank rate, offering wirex users one of the best exchanges rates and a wide variety of supported fiat currency. There’s a small monthly fee – but that normal for a crypto debit card. On ATM withdrawals there’s another small fee – but with enough Wirex rewards you can cover it and still get a small cashback as a bonus. I’ve personally didn’t felt like the Wirex fees are high.

We hope you’ve enjoyed our Wirex review and that you decide to order a Wirex Visa card.

Where can I use the Wirex Visa card?

You can use the Wirex Visa card anywhere Visa is accepted – even for international payments. You can check your cards balance from the Wirex app and you can top it up with EUR GBP USD SGD AUD JPY HKD CZK MXN CAD and CHF. The card issuance process takes a few days and you can top it up with certain crypto assets as well.

Image Source: ElevenNews

Support Zerocrypted

- Trade on Bitmex

- Trade on Binance Jersey

Subscribe to our Newsletter to be a part of our future $1,000 per month contests.