Wirex vs Crypto.com cards

The Wirex company offers cryptocurrency wallets linked to debit cards, digital currency, and fiat currency. The firm provides a Wirex visa card that allows you to load it with cryptocurrencies and use for payment services and withdrawals just like a regular card.It is important to note that the funds are deducted from cryptocurrency balance rather than fiat currency.

Getting started with Wirex is free, but a specific fee is charged when you order a debit card. Wirex services can be accessed through the internet and mobile applications. The service supports the British Pound, the Euro, and the US Dollar. Under cryptocurrencies, Wirex supports Bitcoin, Litecoin, Ethereum, WAVES,XRP and WXT – their native token. Both companies use multicurrency cards, and both of the cards have almost the same supported coins – like BTC, ETH, LTC or XRP.

- Midnight Blue – 0 CRO – 1% cashback.

- Ruby Steel – 2,500 CRO- 2% cashback and 100% rebate on Spotify, metal card

- Jade Green and Royal Indigo – 25,000 CRO – 100% rebate on Spotify and Netflix, 1 guest airport lounge access, metal card

- Icy White and Frosted Rose Gold – 250,000 CRO – 5% cashback, 100% rebate on Spotify, Amazon Prime and Netflix, 10% Expedia discount, Exclusive merchandise welcome pack, bonus interest in lending, Crypto.com Private, 2 guests Airport Lounge Access , metal card

- Obsidian – 2,500,000 CRO – 8% cashback, 100% rebate on Amazon Prime, Netflix and Spotify, 10% Expedia discount, Exclusive merchandise welcome pack, Bonus interest if you’re lending funds, Crypto.com Private, Airbnb 10% discount, Private Jet Partnership, 2 guests Airport Lounge Access, metal card

Card Fees and Limits – Which debit crypto card have the lowest fees?

Most of the Wirex Visa card services are free. Holders of the card are required to pay a monthly management fee depending on the type of currency. We have £1.00, €1.20 and $1.50 that is deducted from the card on a monthly basis depending on the currency type. If your card has no funds, the charges go into negative figures.

If no money is added to the account after two months, the card faces deactivation. For Wirex ATM transaction charges vary depending on the jurisdiction In Europe, ATM charges stand at £1.75, €2.25, and $2.50 while other regions outside of Europe are charged at £2.25, €2.75, and $3.50.

The Wirex card has maximum balance depending on the currency. Users are only required to only have $10,000, £7,500, €8,000 on the card at any one time.The fees for Crypto.com Visa card vary based on the type of card. Unlike Wirex, all cards have no monthly maintenance fees. Each card has a 2% ATM fee after going over the monthly limit which ranges from $200 for the Midnight Blue to $1,000 for the Obsidian Black.

Wirex and Crypto.com Rewards – Who offers the best crypto debit card?

Wirex offers the crypto cash back reward that pays in Bitcoin. Holders of the Wirex Visa card earn 0.5% back in Bitcoins for all store purchases. Furthermore, the platform has unique bonuses for referring friends to the service. You get rewards in Bitcoin when your friend orders a Wirex Visa card and makes their first in-store purchase.For the MCO card, rewards depend on the type of card you hold. The good thing is that all of the Crypto.com cards are actually a Visa debit card, and in a recent AMA, there was an announcement of a virtual card for Crypto.com.

The Midnight Blue has 1% cashback, the Ruby Steel have a 2% cashback and 100% rebate on Spotify, the Jade Green has a 3% cashback and 100% rebate on Spotify and Netflix and the Icy White has a 4% cashback, all the benefits from above and crypto.com private & amazon prime rebate.

The Obsidian card is the best Crypto.com Card with a 8% cashback and a lot of other benefits. The card is pretty expensive however, as it requires a 2,500,000 CRO to be staked at any time. Right now, that’s more than $100,000 – due to the recent crash. But before, that was even more than $200,000.Moreover, Crypto.com have other benefits such as the Crypto earn program – which you can earn up to 18% interest per year.

Notice: The amount is offered per year and not per day. There is no program that can guarantee even a 1% profit per day. Whoever claims that, is a scam. But Crypto.com isn’t. The process is fairly easy. You ‘stake’ your cryptocurrency there while they use it to borrow other people and charge up to 20% interest per year.

So they use investor’s funds to supply money to those in need willing to pay a high interest. Its a great model and the great part is that the funds are offered weekly so you can even try and gen some compound interest out of it.

Availability – Where can you use the Crypto.com card or the Wirex card?

Wirex card is available in some countries. Before the card is rolled out in different jurisdictions, it has to meet some regulations by the specific country.

However, the card is not available in major countries like China or USA. Plans are underway to roll out the services in the United States. The list with the accepted countries where wirex is available can be found here.Crypto.com Visa cards are not available in all regions.

The initial plan by the team was to roll them out in Asia, Europe and then North America. At the moment, MCO Visa cards are available in: Singapore, Europe, Asia Pacific, United States and soon Canada.

Security – How are the top crypto cards companies managing the security?

The Wirex Visa Card uses the 3-D Secure program to protect online transactions. The program is used to link the financial authentication process with a web-based verification. 3-D stands a three-domain model namely, Acquirer Domain, Issuer Domain, and the Interoperability Domain. 3-D Secure offers an additional security layer for online debit card transactions. It prohibits any illegal payment, even if a cardholder’s card number is lost.

Wirex cardholders can block the card from the website and mobile application and can be reactivated if recovered. Furthermore, Wirex card information is anonymous, and no employee has access to it. The information is secured by card proxies stored in the Wirex bank.Crypto.com comes with some unique security features in web-based banking. In case a card has been stolen users can easily block in the mobile application.

Additionally, users can switch on the contact-less payments and ATM use immediately. Users have to undergo the KYC and AML verification before receiving the MCO card. The card also comes with level one PCI DSS compliance.

Pros and Cons of Wirex Card and MCO Card

Crypto.com card Pros

- Has a great Visa Debit Card

- Besides the physical card, a virtual card will be available for Crypto.com since Q1 2021

- Offer atm withdrawals with 0% fee ( in each card’s limit)

- Way better than Coinbase Card, Bitpay card or other crypto debit card

- Accept top-up with traditional currencies ( EUR GBP, USD, HKD, SGD,AUD, etc)

- Card is available into a large number of countries

- No maintenance fees

- Has a cryptocurrency wallet into their app

- Interbank exchange rates for some traditional currencies

- Fees and limits are properly displayed in Crypto.com app at Settings -> Fees & Limits

- Can top-up with BTC ETH XRP and stablecoins

- The payment card is accepted on a large number of vendors, but check their list where you won’t get cashback for your shopping (Down below the tables, at *)

- Amazing cashback depending on the card you pick

- Interest per year offered for staking CRO for the card

- Crypto.com app integrated with Brave Browser

- Great referral system where you can get $25 for bringing someone to the app which orders at least the Ruby card.

- Has a crypto.com app for iOS and Android which is one of the best payment platform out there

Cons of Crypto.com cards

- In the latest cryptocurrency news, the company has made a lot of changes that affected the investors and the price of CRO was heavily affected. CRO went down from $0.15 to $0.065. But, at the beginning of the year, the coin was worth less than $0.03.

- MCO crypto is not extinct, was replaced by CRO

- There’s a large list of vendors where cashback is not available

- Shipping process takes 2-3 months.

- In app support has some periods where they reply after 24h, but the majority of time is under 5 hours.

- The physical card is metal and looks amazing

Wirex Card Pros

- Quick verification to use their app

- Card supports topping up by Crypto

- Have a UK FCA e-money license

- You can get up to 1.5% cashback

- Available for business accounts too

- Over 6000 people on Trust Wallet offered them a 4.4 Rating

- Has Wirex Token that offer cashback perks

- Has a payment platform as well

- You can buy BTC ETH LTC XRP WAVES DAI NANO XLM and WXT at the best rates, as they’re integrated with multiple exchanges. You can also top up with EUR GBP and others

- Interbank exchange rates

- Still better than Coinbase card, Bitpay card or others

- ATM withdrawals are available, but with a fee

- Can do a crypto payment with the Wirex app

- The latest cryptocurrency news were pretty positive for Wirex

- Can top up with traditional currencies as well

- Has a great looking physical card

- The WXT token overperformed BTC and CRO in 2022

Cons of Wirex card

- Too many fees. There’s even a maintenance fee, an ATM withdraw fee and so on.

- Support doesn’t reply too fast

- Only 1.5% cashback

- 1% top up card fee

- Has only a few cryptocurrencies available

- Is not integrated with Brave browser

Conclusion

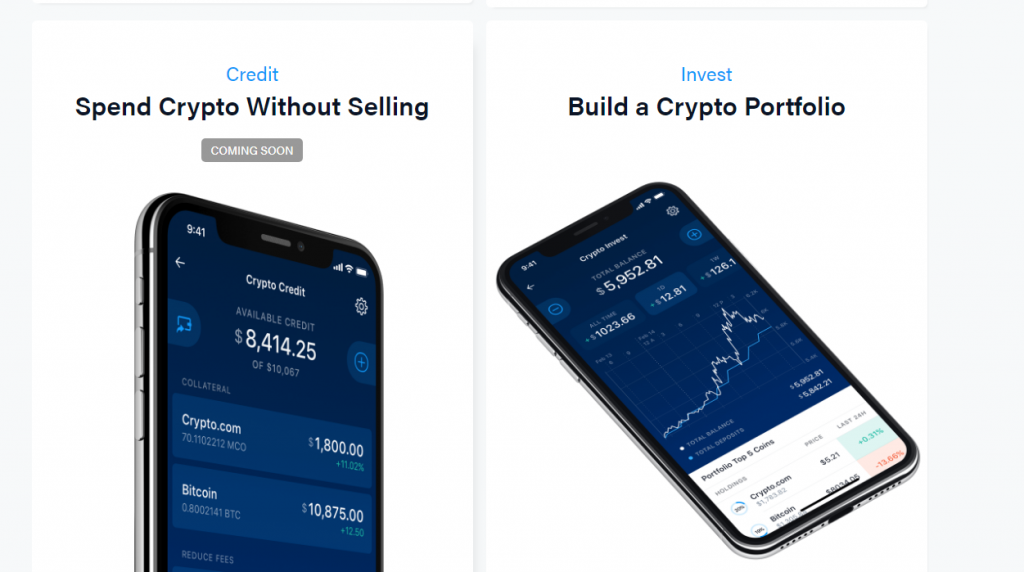

When compared to Wirex card, the Crypto.com card has made a lot of progress since its inception. The security features are better, the app runs smoothly, the bonuses are better and it offers a bigger worldwide coverage. Basically, Crypto.com created more of an ecosystem than a simple app.

You can keep your funds safe there, stake them and receive interest per week ( up to 18% per year ), exchange them almost instantly in the crypto.com exchange and a lot of other features. At this point, Crypto.com is the leader of the cryptocurrency debit cards and their rewards are hard to beat. Moreover, the fact that you can chose from 5 card models is a huge plus – as well as the fact that you can have Netflix, Spotify or Amazon Prime for free.